Corporate governance

Good governance forms the foundation for solid relations between shareholders, the Board of Directors, executives, employees, customers and other stakeholders and encourages objectivity, integrity, transparency and responsibility in the management of the Bank.

The Board of Directors is elected at the AGM for a one-year term. Seven directors and two alternates are elected.

The Board of Directors is ultimately responsible for the Bank’s activities as provided for by law, regulations and its Articles of Association. The Board of Directors formulates the Bank’s general strategy and shall ensure that the Bank’s organisation and activities are conducted properly. The Board of Directors also monitors the Bank’s general activities and ensures that control of accounting and financial management is satisfactory.

There are four sub-committees of the Board of Directors: The Audit Committee, the Risk Committee, the Remuneration Committee and the Sustainability Committee, the last of which was established in 2023. The Committee’s main responsibilities are to formulate a sustainability strategy, develop and standardise sustainability metrics, review disclosure and publication of sustainability data, compliance with laws and rules on sustainability, and ensure continuous education of the Board on sustainability concerns. Amongst other duties, the sub-committees prepare the Board’s discussion of certain aspects of the Bank's activities and follow up on related matters.

Executive Board

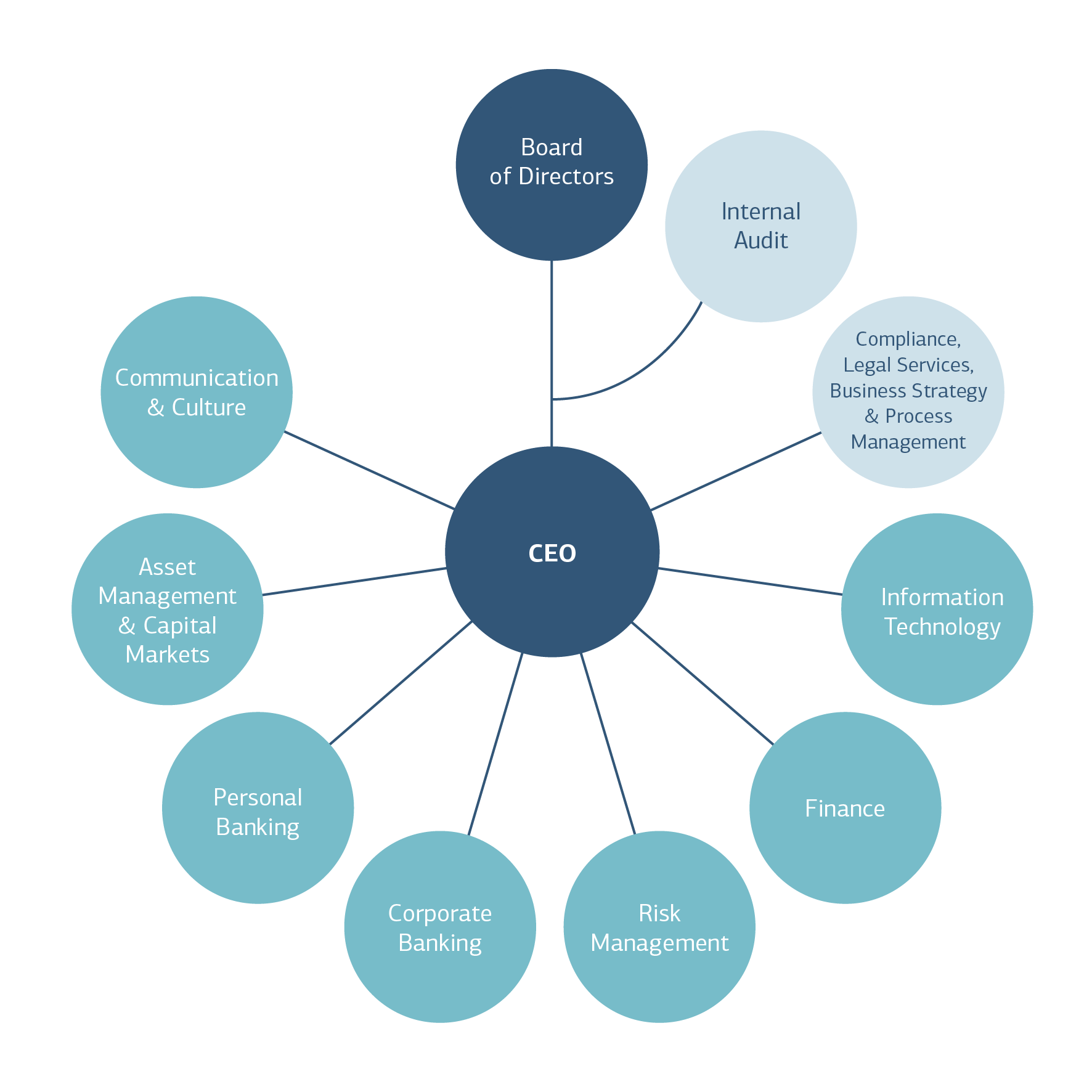

The Executive Board is a forum for consultation and decision-making by the CEO and managing directors. The Executive Board sees to strategy formulation and shall ensure that Landsbankinn's operations accord with current laws and rules at each time. In addition, the CEO has appointed four cross-disciplinary standing committees, comprised of managing directors and other managers, with the aim of ensuring collaboration and implementation of the Bank's strategy. These are: The Credit Committee, the Risk & Finance Committee (RAFC), the Operational Risk Committee and the Project Committee.

Corporate governance statement

The Bank complies with the Guidelines on Corporate Governance published by the Iceland Chamber of Commerce, Nasdaq OMX Iceland and the Confederation of Icelandic Employers, which entered into effect on 1 July 2021.

The corporate governance statement, published alongside the Bank’s annual financial statement, reviews the main aspects of risk management and internal control, the election and activities of the Board of Directors and executive management.

Organisation of Landsbankinn

Landsbankinn’s organisation aims to ensure solid and effective operation while creating opportunities for successful collaboration between departments and groups. Emphasis is placed on ensuring that employees can cooperate on projects across departments and divisions, sharing and enjoying the benefits of diverse expertise. We work as a team, guided by the interests and satisfaction of our customers.

Retail customers

Personal Banking provides all services to retail customers, including the development of digital solutions. The focus is on providing first-rate service by leveraging the Bank’s data resources. We want our customers to receive personal advice in our branches and outlets, and enable them to take care of all main banking business using digital service channels. Service to small and medium-sized companies in rural Iceland is also handled by Personal Banking, in close collaboration with Corporate Banking.

Corporate customers

Service and financing for corporates, municipalities and institutions lies with the Corporate Banking division, which is sharpening its focus on digital service, especially for small and medium-sized enterprises, and self-service solutions. Specialised account managers attend to the needs of companies and legal entities in all sectors. Corporate Banking also provides comprehensive and professional advice on the purchase, sale and merger of companies.

Asset Management & Capital Markets

Asset Management & Capital Markets offers high-net worth individuals, companies and investors assistance in finding the right investment and asset development solutions. The division offers extensive services in the field of asset management, both private banking and professional investor services, in addition to brokerage of securities, currency and derivatives for professional investors and larger customers. Emphasis is placed on personal service, responsible advice and informed decisions.

Finance

The Bank’s funding, liquidity management and market making all fall under the scope of the Finance division. Settlement, accounting and business plans are also under Finance, along with loan administration and transaction services, and sustainability.

Information Technology (IT)

The IT division is responsible for the operation, security and development of Landsbankinn’s digital infrastructure. Its activities are based on multidisciplinary teams and collaboration with the Bank’s other units in order to provide and develop first-rate tech solutions and digital services. There is a strong focus on leveraging data in all the Bank’s activities and to ensure that the Bank continues to lead the way in utilising information technology in the domestic financial market.

Risk Management

Risk Management is responsible for the effectiveness of the Group’s risk management framework. The division is also responsible for information disclosure on risk exposure to various departments and units within the Bank, and external regulators.

Communication & Culture

Previously the Community, this division was renamed as part of organisational changes in 2023, which included moving the sustainability team to Finance. The new name refers to both internal and external communication and the division’s key role in shaping and fostering corporate culture. The division incorporates human resources, marketing, education, PR, economic research, management of property and equipment, security and canteen operation.

Compliance, Legal Services and Business Strategy & Corporate Management

Three departments operate across the Bank and are directly under the CEO. Compliance carries out risk-based internal control to ensure that managers and employees carry out their duties in accordance with the policies, rules and processes the Bank has adopted. Legal Services offers legal counsel to all departments and divisions and works to ensure that the Bank's activities accord with laws and regulations. Business Strategy & Corporate Management supports the CEO in strategy formulation, creates business plans, furthers the Bank's goals and maintains a clear and holistic view of operations. Jointly, these units participate in shaping and implementing policies and methodologies based on the Bank’s strategy.

Internal Audit

Internal Audit is an independent and autonomous function directly responsible to the Board of Directors. The role of Internal Audit is to improve and protect the Bank’s value with risk-focused and objective verification, consultation and insight. Internal Audit evaluates and improves the effectiveness of risk management, control measures and governance processes through systematic and disciplined practices.

Assets sold in 2023

Landsbankinn has adopted a clear policy on the sale of assets, intended to promote transparency and credibility in the sale of assets and build confidence in the Bank.

Securities and other financial instruments listed for trade on a registered market are sold on the market and that process is considered an open sale process. Such transactions are excluded from the table listing sold assets.

In 2023, Landsbankinn sold 22 appropriated assets, six vehicles, shareholdings in two unlisted companies and 182 pieces of art. The total sales value of these assets was around ISK 519 billion.

In 2009, the Ministry of Education, Science and Culture commissioned a professional valuation of the Bank’s collection. It was suggested that pieces in category I would become public property, that category II pieces should not be sold without consulting with the National Gallery of Iceland and that category III pieces would be offered on loan to cultural institutions. Other pieces were marked as uncategorised and the Bank was made free to dispose of them without any provisos. Since the valuation, pieces owned by savings banks that merged with Landsbankinn have been added to the collection and undergone a similar appraisal. In 2019, the Bank owned a total of around 2,200 pieces of art, mainly paintings but also ceramic art, reproductions, photographs and more. Around 1,600 pieces were valued as uncategorised and only such pieces have been or will be sold. The sale value of the pieces sold in 2023 totalled ISK 10.5 million, having regard for sales commissions. Sale took place via open sale process (online auction).

| Assets sold in 2023 | Number | Total |

|---|---|---|

| Residential apartments | 2 | ISK 58,250,000 |

| Building sites | 2 | ISK 58,000,000 |

| Commercial housing | 2 | ISK 265,000,000 |

| Land | 1 | ISK 23,000,000 |

| Building sites for vacation housing | 7 | ISK 16,800,000 |

| Other | 182 | ISK 10,516,600 |

| Shares in unlisted companies | 2 | ISK 62,317,674 |

| Vehicles and equipment | 14 | ISK 24,769,400 |

| Total | 212 | ISK 518,653,674 |

At year-end 2023, sale processes for holdings in 12 unlisted companies were on-going. These holdings are variously owned by Landsbankinn or Hömlur fyrirtæki ehf., a subsidiary of the Bank. Information about these holdings has been disclosed on the Bank's website.

Assets for sale at year-end 2023

A total of 125 assets appropriated by the Bank were held for sale as at 31 December 2023. Their book value was around ISK 175 billion.

| Appropriated assets undergoing sale process at year-end 2023 | |

|---|---|

| Building sites for residential apartments and commercial housing | 6 |

| Building sites for vacation housing | 116 |

| Land | 3 |

| Total | 125 |

Sale of shareholding in Frumtak I and Frumtak GP

In 2023, Landsbankinn sold a 7.4% share in Frumtak I for a selling price of ISK 59 million. The Bank also sold its 19% share in Frumtak GP for ISK 3.4 million.

The sale of the shareholdings in Frumtak I and Frumtak GP deviated from the main rule of employing an open sale process, with full authorisation by the Board of Directors and in accordance with the Bank’s rules on the sale of assets.

The Bank sold one vehicle without advertisement and the sale price, based on the valuation of a car dealer, was ISK 5.2 million.

By clicking "Allow All", you agree to the use of cookies to enhance website functionality, analyse website usage and assist with marketing.